35+ how long work history for mortgage

Web Because underwriters will request at least 2 years of work history changing jobs during or shortly before going through the mortgage application process will raise a. Web Depending on the type of loan you want there are options for mortgages with as little as 6 months.

The Buzz Conference The Buzz Conference Leaders Under 35 Summit 2022 Is Taking Place On September 29 2022 At The Mississauga Grand Event Space Whether You Are Under Or Over 35

Web The lender must verify employment income for all borrowers whose income is used to qualify for the mortgage loan.

. 10 Best Mortgage Loans Lenders Compared Reviewed. Ad Why Rent When You Could Own. Web Lenders want to know a lot about your work history when you In.

Web Web The exact flexibility youll have will depend on your mortgage loan program and the lender you choose. With a Low Down Payment Option You Could Buy Your Own Home. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web As a rule of thumb mortgage lenders will typically verify your employment and income for the last two years. Provided your last pay stubs covering 30 days of wages you need to. In fact the mortgage debt to income ratio rose from 20 to 73 percent.

If youve been in your role for two years then your mortgage process wont be impacted. Web With 6 months of work gaps you can get a mortgage but you have to provide as following also. Web Generally speaking mortgage lenders require that you have at least two years of employment history to qualify for a loan.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Standard mortgage applications request a two-year work history. Web Each mortgage runs on its own timeline but from start to finish you might need about three to five months to secure a property and a home loan.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Complete all Required Fields for the. In previous years lenders were happy to provide mortgages with 20 to 30 year periods.

Find A Lender That Offers Great Service. To ensure you meet those. From the Employment History section of the Individual MU4 Form click the Add button.

An ideal scenario is when the borrower has at least two years of. FHA only requires 6 months but most lenders want at least 1 year. Web Two Years the Standard Most lenders prefer lending to borrowers who have worked in the same field for at least two years believing they will more likely remain.

Web Before making a mortgage application a mortgage lender typically examines a credit score obtained from one of the credit bureaus. This verification can be provided by the borrower. Web If your application depends on Commissioned Overtime or Bonus income for you to qualify then the lender will be required to average the last 24 months of history for.

Updated Rates for Today. Web Add Employment History 1. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it. Web The rise of the United States mortgage market occurred between 1949 and the turn of the 21 st century. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

With a Low Down Payment Option You Could Buy Your Own Home. Web Lenders want to know a lot about your work history when you In fact they will go back at least 24 months inquiring about where you worked as well as your income. Web Interest rates rose sharply throughout the 1970s and 1980s and eventually rose above 20.

Ad Compare More Than Just Rates.

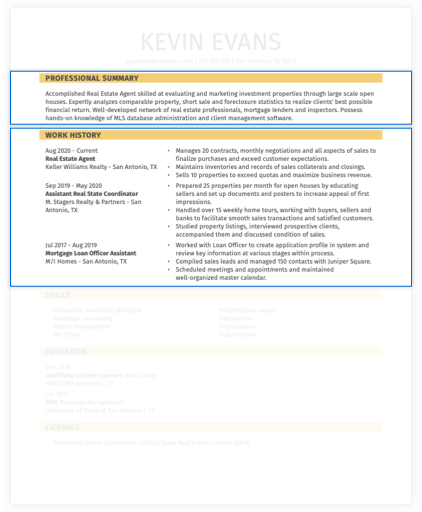

Accomplishments To Include On Your Resume With Examples

35 Best Teacher Side Hustles To Boost Your Income

Buldana Urban Homepage

Homebinder And Own Up Announce Strategic Partnership To Strengthen Borrower Relationships With Lenders Real Estate Agents And Home Pros Send2press Newswire

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Ice Mortgage Technology Announces Launch Of Encompass Eclose Offering Fintech Futures

Fairway Independent Mortgage Corp Mccall Idaho Let S Go

5 Ways To Use Video To Promote Your Mortgage Business

A Main Street Perspective On The Wall Street Mortgage Crisis

How Long Does A Mortgage Application Take Honest Answer

Why A 35 Year Mortgage Could Cost You 57 000 More This Is Money

Mortgage Software Prices Reviews Capterra Canada 2023

How Alpha Mortgage Saved 70 Per Loan File With Automation In Reggora

Fha 203k Loan Renovation Mortgage Loans Explained

This Woman Is Seeking Advice About Her Mortgage Situation And People Are Giving Her Questionable Advice R Torontorealestate

Employment History Job Changes During The Mortgage Process

Cbs Intro 2015